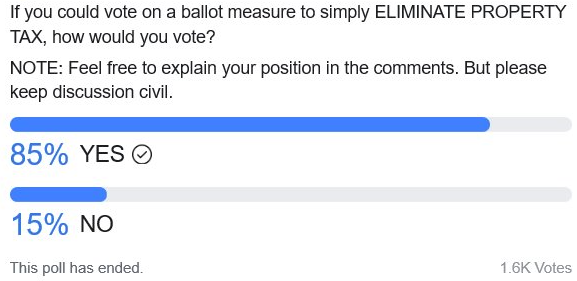

We recently ran a poll on Facebook that asked a simple question, “If you could vote on a ballot measure to simply ELIMINATE PROPERTY TAX, how would you vote?” The results were overwhelmingly in favor of the idea.

Admittedly, this poll was not what some would call “scientific”. However, I can tell you that a group of people banded together and raised money to have professional polling done on this issue. And while I’m not at liberty to share those results, I can tell you that they’re very encouraging. Not only do they show that there’s an appetite for eliminating property taxes in North Dakota, but the polling shows that this is not a partisan issue. Republican, Democrat, or otherwise— doesn’t really seem to matter. There’s support across the political spectrum.

For some, this may be surprising. After all, the 2012 efforts to end property taxes in North Dakota went down in flames at the polls. But let’s not forget that proponents of that measure were significantly out funded. Empower the Taxpayer had a paltry $21,760.41 in campaign contributions. This compared to their opposition — known by the misnomer of “Keep It Local North Dakota” (KIL-ND) — who blasted the electorate with a fear campaign on $579,140.

Aside from Empower the Taxpayer being out funded during that 2012 effort, North Dakotans were promised by members of the State Legislature that they just needed one more chance to “reform” or “fix” the mess known as property taxes. Empower the Taxpayer warned that it’s a tax that cannot be fixed— it’s inherently flawed, not to mention horribly immoral. But between the fear campaign against what was then known as Measure 2 and what has now proven to be empty promises of legislators, the people voted down the effort.

By the 2017 Legislative Session, it was evident that the so-called “buydowns” of the legislature weren’t a “fix” at all. In too many instances they simply resulted in bloated local government budgets and ever increasing property taxes. This led one Republican legislator to express on the House floor that, “We want to get out of the property tax business…” and another to say, “The 12% property tax buydown is unsustainable…The state should not be in the property tax business.” And with that, the buydowns were ended.

In that same 2017 Session, the state took over 100% of the funding for social services and suspended the ability of county governments to levy the 20 mills for property taxes they had in the past for them— a move that came with a “lighter price tag” than the buydowns. So, once again we had folks at the state level claiming lasting property tax relief and local folks warning of rising property taxes. It was the same old finger pointing game taxpayers are all too familiar with.

A look at the recent 2019 Legislative Session shows us nothing but more problems. Not only were a variety of proposals defeated to address property taxes, but we even had the legislature passing bills that granted more authority for local governments to raise them. It’s insane.

In recent weeks, we continue to see articles in North Dakota news that indicate property taxes around the state are expected to rise. Examples are found here, here, and here. There’s no doubt the arguments in some places will be that the increases aren’t that significant. It’s like being slowly bled to death and telling yourself the bleeding isn’t profuse.

Things were so pathetically ridiculous during the 2019 Session that the Senate even defeated a proposal to simply study the “feasibility and desirability of providing an alternative funding mechanism” to property tax. As a side note, the person who carried that bill to the Senate floor — and asked for it to be defeated — was Senator Jim Dotzenrod (D – District 26). Yes, that same Jim Dotzenrod who sponsored Senate Concurrent Resolution 4013, which called for the state to “study the plight of rural groceries”. You can see this week’s article from the Minot Daily about it here. Apparently studying government in groceries is good, but studying alternatives to property tax is bad. But I digress.

It’s no wonder the people seem to have an appetite for eliminating property taxes. Many are wising up to the reality that the State Legislature can’t — and in fact they don’t want to — fix the problem.

There’s many reasons to eliminate property taxes. We’ve written about some of them in the past. Chief among them is that so long as property taxes exist people will never truly own their own homes— a fact that North Dakota’s own training manuals for tax assessors admits to.

Yet, in order to be successful in eliminating property taxes, messaging must be on target. Many people who support the idea still want assurances of how things funded by property taxes will be paid for going forward. It’s a reality that cannot be ignored.

Back in February, Rep. Rick Becker (R – District 7) gave a floor speech for the ages proving — with the assistance of Legislative Council — that North Dakota can eliminate both property tax and income tax without raising taxes. He then reiterated it with this speech at the conclusion of the 2019 Session.

Do the people want to scale back the size of our bloated state government as a means of eliminating property taxes? Or do they prefer to shift the associated costs to other taxes? These are the kinds of questions that will need answering.

Property taxes can — and should — be eliminated. There’s no question about it. But if a coalition from the grassroots is going to organize and give this another go at the ballot box, then they need to learn from the past. Simply put, an effective campaign cannot be ran on $27,000. It just can’t. If the funding isn’t there to do this — and to do it right — then stay home, because the opposition will eat you alive.

There’s much more to be said on this issue. For now, I can tell you that there’s an appetite to eliminate property taxes in North Dakota, but a well-funded and organized effort will be required to do it.

PLEASE LIKE & SHARE!

Sources:

- https://ballotpedia.org/North_Dakota_Property_Tax_Amendment,_Measure_2_(June_2012)

- https://theminutemanblog.com/2017/04/17/property-taxes-let-the-finger-pointing-begin-again/

- https://bismarcktribune.com/news/state-and-regional/property-tax-increases-coming-in-nd-after-legislative-changes-auditors/article_00ab7608-275f-513f-8f7a-d9ffde512c15.html

- https://theminutemanblog.com/2017/04/17/property-taxes-let-the-finger-pointing-begin-again/

- https://theminutemanblog.com/2019/02/14/north-dakota-house-rejects-bill-to-reform-property-tax/

- https://theminutemanblog.com/2019/02/18/nd-house-senate-each-pass-bills-that-can-increase-property-taxes/

- https://bismarcktribune.com/news/state-and-regional/cass-county-to-mull-property-tax-increase-to-help-fund/article_259bacec-13b9-5dd6-8f87-80557160d7d9.html

- https://www.kvrr.com/2019/07/23/mayor-mahoney-releases-preliminary-2020-budget-includes-property-tax-increase/

- https://www.minotdailynews.com/news/local-news/2019/07/ward-county-to-consider-property-tax-to-back-up-sales-tax/

- https://theminutemanblog.com/2019/03/21/as-expected-nd-senate-defeats-bill-proposing-study-to-eliminate-property-tax/

- https://www.legis.nd.gov/assembly/66-2019/bill-index/bi4013.html

- https://www.minotdailynews.com/news/local-news/2019/08/nd-legislators-seek-answers-to-struggles-of-rural-groceries/

- https://theminutemanblog.com/2018/02/01/some-reasons-we-support-eliminating-property-taxes/

- https://theminutemanblog.com/2019/04/16/confirmed-the-state-admits-you-dont-own-your-home-property-2/

- https://theminutemanblog.com/2019/02/15/tax-spend-the-floor-speech-every-north-dakotan-should-hear/

- https://theminutemanblog.com/2019/05/01/rep-rick-beckers-stellar-floor-speech-at-conclusion-of-66th-legislative-session/

- https://bismarcktribune.com/news/local/govt-and-politics/this-dog-is-digging-gov-burgum-signs-operation-prairie-dog/article_6fe5f12f-66da-5915-940e-e1ab34427e39.html