The following article was first published on The Minuteman June 29, 2017.

The title of this article is not an embellishment… at all. Those of us who advocate for the abolition of property taxes have said it time and time again. So long as property taxes exist, we will never truly own our homes and property. And not only am I telling you this again, but I am going to show you that the State of North Dakota has admitted to it.

Two nights ago, I had a tax assessor call to inform me that they had some very important information I would be interested in. Being busy at the time, I asked if they could send it to me electronically. They agreed, but the images were so distorted that I couldn’t read them. With a phone call to this individual the following day, we agreed on a time to meet to look over the information. I was nothing short of shocked to see what I’ve been telling people for years in print– from materials provided by the government.

Upon my arrival, this good man handed me a spiral bound book titled, “An Introduction to the Income Approach to Value”. He explained that this was just one of the training manuals provided by the state for local tax assessors to utilize in their coursework for certification.

He reminded me that all of this was the result of the North Dakota Legislature’s decision a couple of sessions ago to change the requirements for being an assessor. A decision that forced a vast number of local assessors to quit– therefore leaving local governments to turn to an outside entity to come in to do their assessing. For example, an out of state company named Vanguard is used by many local governments across the state. So much for local control, right?

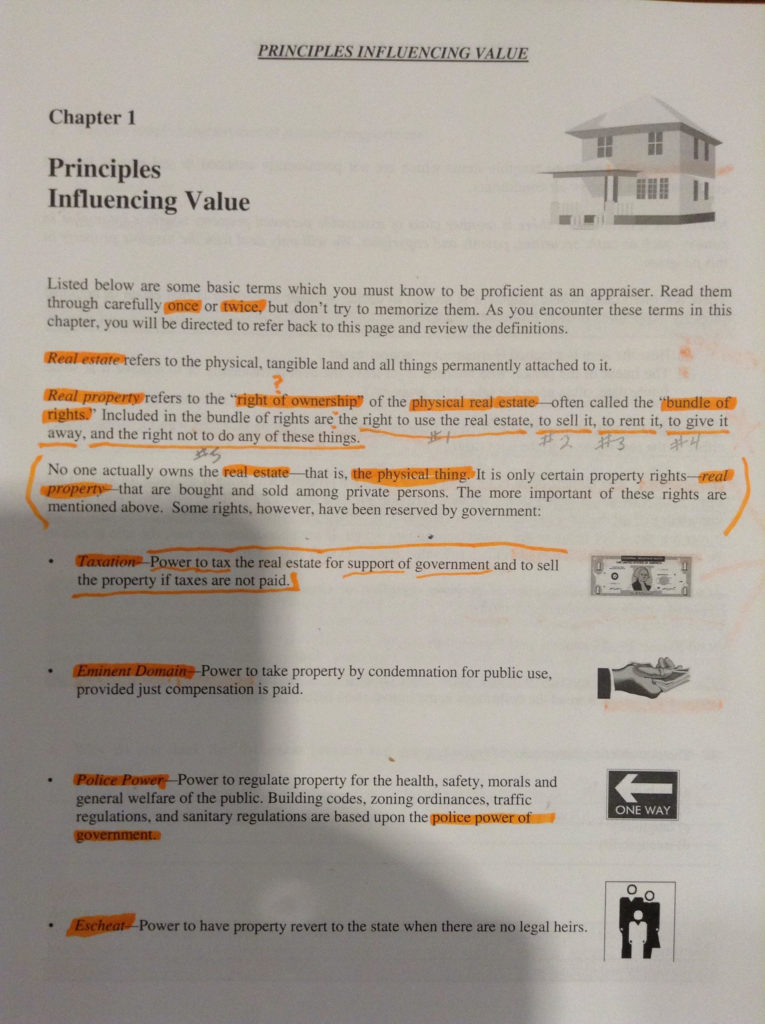

With the book in hand, my attention was called to “Chapter 1 – Principles Influencing Value” and I began to read an introduction that declared the importance of “some basic terms” which every assessor “must know to be proficient as an appraiser”:

After reading the distinction between the terms “real estate” and “real property”, it was followed by the stunning admission of what many of us have said for years:

Did you catch it? Let this sink in for a while… ”

“No one actually owns real estate– that is, the physical thing.” And may I remind you that “real estate” is not only the “tangible land”, but it is also “all things permanently attached to it”. That’s right, if your home is “attached” to the “real estate”, well, then you don’t own that home either, because it too is considered “real estate”.

No, according to these materials – which are now utilized by the State of North Dakota – you only have a “bundle of rights”. That’s correct, you can ” use the real estate”, “sell it” (i.e. sell the right to use it), “give it away” (i.e. give away the right to use it), or none of those things, but you don’t own it.

And you’d dang well better make sure you pay the taxes, regardless of what your income is. To that, we have this admission:

Yep, “Property taxes have nothing to do with the owner’s ability to pay.” A fact we’ve always known, but like the others it is stunning to see the admission in print.

And then we have those blessed “rights” that “have been reserved by the government”:

Unfortunately, the eye-openers didn’t end with the material shown above. There’s more. A lot more. But too much to fit into this article. Yet, I’ll give you one little tid bit from a recent Q & A with Vanguard in Cavalier County:

“If I do not let them in or even on my property, how will that affect my assessment?

“If Vanguard is not allowed on your property or inside of the residence or commercial business, the assessors will put a value on which they feel is fair. The property owner will not have the opportunity to question Vanguard’s value if the assessor is not allowed inside at the time of the assessment.” (Emphasis Added)

Needless to say, the intrusion advocated for and trained in this manual should make the hairs on the back of your neck stand on end. All of it together should result in a property tax revolution that this state and country is in desperate need of.

Yes, folks, we are just the government’s personal ATM machines. And that’s not just me saying this. This is them literally admitting to it. If you’re not mad yet, you should be. There’s simply no justification for continuing to have a property tax. All those government services so many love and adore can be funded in other ways.

It is past time that we end the abuse known as property taxes. It is time to truly own our homes and property. Abolish the property tax now!

Sources:

- https://www.nd.gov/tax/data/upfiles/media/assessment-officials-certification-brochure_1.pdf?20170629171623

- http://camavision.com/

- https://www.cavaliercountyextra.com/2017/06/16/vanguard-assessment-answers-common-questions/